Episode Summary

Just as the 2020 elections were fading into America’s rear view mirror, Elon Musk, the CEO of Tesla and SpaceX, cast the political and media worlds into chaos by taking ownership control over Twitter.

The purchase didn’t directly affect most people because Twitter has always had a much smaller user base than rivals like Facebook or Instagram. But Twitter is far more influential than its direct audience numbers. That’s because it’s actually the place online where most of America’s political junkies–activists, politicians, and journalists–come to talk.

It all seems to have started as a joke, however. Musk offered to buy Twitter at a price of $54.20 per share, 420 being the very, very old reference to marijuana. After his Tesla stock price went south dramatically, Musk tried to get out of the deal but was forced into it by a lawsuit from Twitter. Since then, Musk has brought the site into complete chaos, reinstating a number of accounts that had been banned for promoting hatred and violence and disinformation, including, most famously, Donald Trump.

While he appears to have had no real plan for Twitter beforehand, what has become very evident is that Elon Musk has become radicalized by the far right, a path that has become increasingly common in recent years for wealthy white libertarian men who just a few decades ago actually saw themselves on the political left, before the re-emergence of populists like Bernie Sanders and Elizabeth Warren.

There’s a lot to talk about Musk and Twitter and how he fits into the larger tradition of the libertarian right within Silicon Valley and the American political right as a whole. We’re pleased to feature two panelists to discuss this topic. Jacob Silverman is the co-author of the forthcoming book Easy Money: Cryptocurrency, Casino Capitalism, and the Golden Age of Fraud, which he’s co-writing with the actor, Ben McKenzie. We’re also joined by Chris Lehmann, who is the Washington Bureau Chief of The Nation magazine and the former editor of The New Republic.

Transcript

MATTHEW SHEFFIELD: We’ll get started here first with you, Jacob. So you have kind of looked at more of the contemporary angle of some of this in your recent journalism, including a piece that you wrote for the New Republic. So tell us, I guess first of all, the context for Musk, and I mentioned a little bit in the intro, but who is he, and where’d he come from, and has he always been this sort of right wing troll, basically that he currently is [00:04:00] operating as.

JACOB SILVERMAN: Well, to answer the last question first, I’d say I think the, the right wing trollishness has definitely come more to the fore in recent years, most prominently with the recent acquisition of Twitter, where you can really see his social relationships playing out in real time, basically. But Elon Musk, a lot of folks know, he grew up in South Africa, came to the U.S.

There’s some dispute about what kind of college degree he has, because a constant thing about Musk is that he lies and/or has exaggerated, or just otherwise obfuscated throughout his whole career, really. So Musk got a degree. He used to say he had a degree in physics, I believe, but some recent reporting indicates it’s in economics.

He was an early executive at PayPal. He merged a company called X.com with basically with Peter Thiehl’s company and created PayPal. He is original member of the “PayPal Mafia,” as it’s called, which has become really influential in Silicon Valley. A lot of companies came out of that.

So he’s associated with folks like Peter Thiehl, or David Sachs, or Max Levchin, Reid Hoffman. All these folks are mostly on the political right in one form or another, who started at PayPal, made enormous amounts of money, and then made even more money investing in other companies. Famously, Musk then became part of Tesla. He often presents himself as a founder of Tesla. He is not. Similarly, he often presents himself as a founder of PayPal. He is not.

But actually a very interesting part of Musk’s exit agreement with PayPal was that they describe him as a founder. They kind of ret-conned him into the company lore as a founder, but he is not. And so this kind of exaggeration of credentials, and of his place in these companies is something that you see throughout his career.

I believe he is the founder of SpaceX, and so now technically, he’s the CEO of three companies– of SpaceX, Tesla, and Twitter. And Musk’s career has always been sort of a high wire act. He has borrowed a lot of money throughout his career. I mean, he’s a very rich man by some measures, the richest man in the world. For probably last couple decades, he’s often borrowed against either his holdings, [00:06:00] his stock holdings, or simply borrowed from friends. Earlier in his career, he was borrowing a lot of money to simply maintain his lifestyle.

I think what’s important to know about Musk is that one, he’s not the most reliable source, especially about his own sort of holdings and his own career and actions.

And that despite being enormously rich, and being rich for a long time, he’s often been on a very shaky financial foundation, which I think is certainly the case even today.

You mentioned in the intro that Musk’s Tesla holdings have plummeted in value, and that’s why he tried to get out of the Twitter deal.

So, he’s always been sort of precarious in a way. Maybe precarity is the wrong word, but again, this sort of high wire act where, you know, there there’s a possibility to swing for the fences, or a possibility to lose it all. And that’s sort of the carnival barker type personality that Musk, I think, has.

SHEFFIELD: Yeah. And in that respect, he has some similarities with Donald Trump there for sure.

SILVERMAN: Sure. He’s a show boater. He very much curries favor with the public, and in recent years, it’s impossible to deny that he sort of turned into this right wing trollish type. It’s actually been somewhat revealing who he brought into Twitter, how he talks about dispelling the ‘scourge of wokeness’ from Twitter, and who he talks to on Twitter, which is almost exclusively his friends and right wing influencers and random sycophants.

So I don’t know if Musk has a concerted ideology of his own, but he talks about free speech, as a free speech fundamentalist of sort. But in practice he is right wing, I would say, and you can see it playing out in his relationships and his actions and his politics and all those sorts of things.

SHEFFIELD: Yeah. All right. Yeah. Well, and that’s, I think that’s true and, and we’ll get further into that. So, but there is kind of a historical aspect here, Chris, to Musk and his recent behavior. He fits into a tradition of libertarianism on the political right and actually within Silicon Valley itself from the very beginning.

You want to talk about any of those angles you prefer here? And then we’ll go from there.

CHRIS LEHMANN: Oh, sure thing. Yeah, it’s definitely the [00:08:00] case, the history of the American right, especially from the end of World War II, up to the present day is full of these kind of obscenely wealthy hobbyists. The one who leaps to mind is Robert Welch, who is the founder of the John Birch Society, and actually a candy mogul, created, appropriately enough, and gave the world the Sugar Daddy. So, yeah, because of the structure of the American social order, people who have immense wealth automatically command a great deal of public deference and respect.

They’re treated as these kind of culture heroes. Even though, as Jacob pointed out, Musk acquired Tesla and didn’t actually create the, the model for the electric car. He is nonetheless, has this vast following of, of kind of other tech bros who see him as, this person who is, doing all this benevolent work to advance progress and, and move humanity to a, a better future.

It’s same with the SpaceX Empire. What’s interesting is that both Tesla and SpaceX are immensely dependent on government contracts. So you have this additional paradox of a part of the economy that, which is also true of Silicon Valley, the whole internet revolution was rooted in government funded projects like DARPA. And yet there is this fierce hatred of government that’s embodied by Musk’s former colleague Peter Thiehl, who Jacob mentioned earlier

SHEFFIELD: Who is also dependent on the government heavily.

LEHMANN: Oh, absolutely. Yeah. His Palantir empire is both scary in terms of the advance of the surveillance state and almost completely dependent on government contracts.

So there is this paradox. It actually goes all the way back to the initial Cold War, where you had in the part of the country where you are, Matthew, this vast aerospace empire took root in Southern California. And it was a major driver of the post-war boom. It recruited a lot of educated engineers, [00:10:00] physicists, and the like, and they glommed on to this libertarian ideology. I think libertarianism both appeals to the, the kind of one quick fix kind of model of thinking of social problems and progress. And there’s not really a diplomatic way to put it, but it appeals to an arrested adolescent mindset.

People who are, who have been brought up, as Elon Musk definitely has, to see themselves as the golden child of Fortune, as people who are, the default, these are all white guys, and they are just understood–

SHEFFIELD: Most of them born wealthy as well.

LEHMANN: Yes. And they are understood as the sort of natural arbiters of progress and drivers of history.

So libertarianism is an attractive ideology to this social cohort, because it basically reflects back to them the ideal world in which they think they have legitimate power. So it’s not shocking– even though Musk took a while to evolve into the fully pure right libertarian figure he is– all of the social determinants were there at the outset.

And certainly the PayPal Mafia, which Jacob referenced. I think future historians will regard this as like a disastrous formation of a massive transfusion of capital to people who are kind of sociopaths who have contempt for other social groups and have this kind of immensely hubristic understanding of themselves as the spirit of market justice incarnate.

SHEFFIELD: Yeah. And the other thing that’s kind of interesting though is that in the 2000s, slash 2010s, the people who had this ideology, except for Peter Thiehl, they weren’t identified with the Republican party explicitly. And in some regards, they actually seemed to have seen themselves as on the left.

LEHMANN: Right. They [00:12:00] were socially liberal values, tolerance, diversity. As we’re seeing at the exodus of Twitter illustrates, Silicon Valley is heavily dependent on underpaid immigrant labor. The remaining core of engineers at Twitter are people on H2B visas because they don’t have a choice really.

If they leave the company, they’ll, many of them may be forced to leave the country. So, yeah. And there was this, there was a famous article in the nineties called “The Californian Ideology,” which tried to set out the worldview of the emerging tech industry. And it did stress, there was this sort of residual Bay Area kind of lifestyle liberalism that survived the sixties, but I think this article was prescient in a lot of ways, because it did zero in on libertarianism as the kind of nexus of belief in this new socioeconomic formation.

SHEFFIELD: Yeah. Jacob, did you want to add anything on that point there?

SILVERMAN: Well, I think the “Californian Ideology” essay is great. I’m blanking on the names of the co-writers there too. But you see it being passed around still these days or on Twitter elsewhere, because it really did, as Chris was talking about, chart this path of how did these people start as hippies who were sort of counter-cultural or doing sort of experimental things, even in the context of like Xerox PARC, that research lab, and then within 10 to 20 years, they’re all working for Microsoft and big corporations. But still sort of consider technology as a driving force and even as a countercultural force. And so I think you see a lot of the kind of justifications also that people in tech use for their actions or for the power to themselves in the “Californian Ideology,” and in the new iterations of it.

They certainly do see themselves as the movers of history. And also I think the, the more recent change is that there’s a real exhaustion with politics as sort of standardly done. Politics as usual. And that I find very understandable, because, I mean, just look around. Of course,[00:14:00] there’s sort of a dissonance there because a lot of these companies are heavily involved in government contracts or dependent on even just political connections and lobbying.

But at the same time, they express a real disgust or even contempt for everyday people and politics. And so they think that technology and their own actions will be, will be kind of drivers of progress. And if other people have a problem with that too bad .

LEHMANN: Mm-hmm.

SHEFFIELD: Yeah. And just to go back in the history further, you look at the early Silicon Valley entrepreneurs, so whether that’s Andy Grove with Intel or Steve Case who was involved in a number of different things including AOL in the eighties, Scott McNealy with Sun Microsystems, basically all of these people just naturally kind of gravitated toward the Republican party in the eighties, nineties.

And Microsoft was kind of an aberration in that they tried not to be political. They just thought that government didn’t know what they were doing, and so they were just going to ignore it. And so they kind of opted out. And IBM was obviously a huge, huge player in the seventies, eighties, nineties. They were bipartisan givers.

And so this whole idea that Silicon Valley was just this incubator of left wing elitism, it’s just nonsense.

SILVERMAN: Mm-hmm.

SHEFFIELD: And as a historical matter, as things got going, there was kind of a bifurcation with the Christian Right. And some irritation with them.

Is that, is that anything that you’ve come across at all in your research, Jacob?

SILVERMAN: Well, certainly you don’t hear a lot of religion expressed in Silicon Valley. I mean, there is actually a contingent of Hindu nationalists, I would say, who are big [Narenda] Modi supporters, but that, that’s not necessarily something we need to dwell on.

But under the Obama administration, you had very close ties between Silicon Valley and the government, but I think what we’ve seen in the last couple decades is that there’s a certain malleability to tech politics. I mean, they’ll work with who’s in power and, by default, a lot of them do lean right, because they’re basically corporatists.

But you don’t really see much of the kind of religious [00:16:00] nationalism or ideology that you might see on sort of the mainstream right. Mitch McConnell types and people like that, they more represent the corporatist wing of the Republican party and have found a pretty comfortable home there.

Of course, I mean, neoliberal Democrats have been just as embracing, you had numerous Obama officials go to work for big tech companies, Amazon, Uber, other places. So in a lot of ways, there’s an evolving bipartisanship here. But if you ask a lot of these folks, they’ll say, oh, I am so socially liberal.

But when it comes down to it, they represent the kind of forces of concentrated power and wealth, that we do more often identify with the right.

SHEFFIELD: Yeah. Well, and Chris, I mean, what do you think is sort of responsible for this transition? To me, it seems like the Democratic party decided to start returning to its roots in terms of economic populism and that basically triggered the libertarians.

LEHMANN: A wing of the Democratic party expressed interest in economic populism. There’s still, I would argue, the dominant wing of the party is still very much aligned with corporate interests. Silicon Valley has been a major funding base of the party across the past 30 years. So yeah, I think what Jacob was saying is true that any sort of big corporate interest is going to be purely instrumental and certainly in terms of its giving patterns.

We saw this even with the collapse of the FTX empire under Sam Bankman-Fried, who had been the number two donor for the Democrats. But his partner whose name I’m blanking on now–

SILVERMAN: Ryan Salame.

LEHMANN: Yes, thank you. Also gave extravagantly to the the Republican party because they want to game the regulatory system in Washington, so whoever is in charge, they’re going to need influence.

But I do think it has been true, sort of going back to the “Californian Ideology” piece of it that the reigning worldview in Silicon Valley has always been anti-government. There is both this kind [00:18:00] of anxiety of influence, hatred that dates all the way back to the aerospace days in Southern California.

But there’s also the ideology of disruption, which is a profoundly conservative notion, even though it comes swabbed in this revolutionary market rhetoric. It was the brainchild of Clayton Christensen, who is a Mormon management theorist who wrote The Innovators Dilemma, which is a bible among Silicon Valley entrepreneurs.

And it’s like a lot of management tracts in general. It’s a very denuded social world, one in which all of the behavior that is determinative comes from heroic entrepreneurs, and they’re banging up against the gray walls of conformity, of regulation, of government. And it’s always and forever their job to disrupt.

And what’s interesting, I mean, this is a whole other podcast probably, but disruptors don’t actually create anything. And we see this most dramatically in the case of Sam Bankman-Fried, crypto is, just pure grift, top to bottom. There is no underlying economic productive activity.

And yet, it’s disruptive in this really superficial sense of allegedly challenging the state monopoly on currency and permitting people to have all kinds of anonymized financial transactions. It is the right wing Valhalla, you have maximum economic power and basically zeroed out government control.

It’s no wonder that libertarians, throng to something like crypto. It’s no wonder that also Democrats as, as we’ve been saying, all these major institutions were in love with Sam Bankman-Fried up until the moment that the wheels came off and it became clear that emperor had no clothes, to mix metaphors ,sorry.

And it’s an interesting moment, and again, tech bros can command this kind of cultural deference because there’s been, literally for a generation, like in my industry, the [00:20:00] media, there’s just been unbelievably fawning coverage of anything that any major tech company says or does.

You just have to go back to every release of the iPhone. It’s a dumb product that is tinkered around the edges, and yet every time one is trotted out, it’s on the front page of newspapers. It’s a ridiculous model for journalism, and it’s a ridiculous model to understand how business actually operates in public life.

SHEFFIELD: Yeah. Well, Jacob, you’re writing a book on cryptocurrency. This obviously is a subject of interest to you as well.

SILVERMAN: Yeah, I was, I was very glad to hear Chris’s assessment there. I mean, I, I think one thing about crypto that he said that deserves highlighting is there’s no real productive economic activity associated with it, which is actually why sometimes when I speak to people in finance or business who are definitely not on the left, they find they find crypto really frustrating because it’s a very poor allocation of capital.

There have been billions of dollars poured into it, and we’re getting very little for it. It’s mostly funneling money from, as I say, from information poor retail investors, everyday people up to the VC and tech capitalist class. One thing I think that crypto does highlight is that libertarian foundation or strain that runs through tech.

There’s a good book by David Golumbia about Bitcoin and about its kind of right wing ideological foundations. And now of course crypto has grown, well now it’s shrinking, but it, it grew to be sort of more consumer product and, and involve more companies, more countries, people all over the world.

But that original anti-state ‘I want to do what I want,’ hardcore libertarian foundation, even Sovereign Citizen type attitude, which you do see in crypto, that’s been there from the beginning. And I would argue that the people who really run crypto. Because it’s not the decentralized free market it’s portrayed as, but rather it is kind of a closed group of men who basically run this industry.

We know a lot of their names. Until recently, Sam Bankman-Fried was one of them. They really just want the freedom to [00:22:00] do what they want, and I think a lot of them are very ideologically motivated. And you can hear it in some of them. Sam himself, I think, was more of an operator, glad to play any side he could, but people like Jesse Powell, the CEO of Kraken, which is under investigation for violating sanctions. He’s highly ideological.

Anyone involved with Bitcoin and El Salvador, or just what are called “Bitcoin maxies,” Bitcoin maximalists, you hear all the hardcore libertarianism. The state can only be a tyrant and I deserve to transact freely, however I want, in whatever manner I want. That’s really an underlying ethos and political foundation here.

I think the larger grift of crypto is that it’s brought a lot of people in with the traditional tech mantra of progress, of creative disruption– as Chris was talking about– that it could be a liberatory, even utopian force. And one reason why I glommed onto crypto as a critic was because I was seeing the same stuff 10 years ago with social media.

And I wrote a book critical of tech power and social media and the growing tech surveillance state that came out in 2015. And, at the time, Mark Zuckerberg was saying that Facebook would lead to world peace. He actually said that. There was a section on Facebook’s website where they highlighted people from warring countries who talk to each other, like Israelis and Palestinians and folks like that, or people from India and Pakistan.

So there was the same kind of, it, it differed in some of the particulars, but the same kind of utopian rhetoric around social media. And of course after 2016 especially, that’s when some tech journalists finally woke up and, and started seeing that there are huge negative externalities, and this is nothing like what we were promised.

And I think that’s the stage we’re starting to enter into crypto right now. There’s a lot of denialism. It’s going to be very messy to clean up. There’s a lot of problems to still play out. So we’re not necessarily near the end game, but we’re, we’re kind of going through that cycle, I think of, of disillusionment and maybe the public’s starting to realize what is actually being pushed on them here.

SHEFFIELD: Yeah. Well, and I think what you were saying about the idea of [00:24:00] this ideology of I should be able to trade whatever I want or say whatever I want, it kind of fits to, to your point, Chris, about libertarianism as kind of this juvenile reactionary philosophy. And all of this kind of goes, you could argue, goes back to Ayn Rand, much even further than Silicon Valley or management consultants.

SILVERMAN: Everyone in tech’s favorite book is Atlas Shrugged or some other Ayn Rand book.

LEHMANN: Yeah, it’s it, it is kind of weird that the, the market for libertarian thinking has not been disrupted, right? (laughter) A 70-year-old doorstop of a terribly written novel that is the go-to source of the gospel.

I did, speaking of the gospel, wanted to pick up the thread you mentioned earlier Matt, about the libertarian-r eligious right alliance and what’s unstable about it. But I think it’s also true that you see a lot of crypto fans who are evangelical right wingers.

There’s actually someone in my extended family who is a pastor who cashed in on crypto and bought a house in Idaho so he could live apart from the raving Democrats in Washington state where he was living previously. And David Golumbia has also written on this element too. Crypto has become a kind of object of worship.

SILVERMAN: Prosperity Gospel in its own way.

LEHMANN: It is, yeah. This goes back to my book, which was published in 2016. The evangelical political vision has become so fiercely individualist in a lot of ways, even though, at the policy level, there’s a lot of conflict between libertarianism and evangelicalism. Libertarians generally don’t like to see drug laws enforced. They’re pro-abortion, they’re pro-gay marriage. All of these signal culture war issues obviously have made across time the evangelical-libertarian alliance pretty dicey. But it is interesting in the realm of political economy, there isn’t a lot of breathing room between the two movements that I can see at least.

SHEFFIELD: Yeah. Well, and actually, and Steve [00:26:00] Bannon actually has a cryptocurrency as well.

SILVERMAN: Oh yeah. He has a long history in the industry actually, yeah.

LEHMANN: Yeah.

SHEFFIELD: Yeah. As a former Goldman Sachs executive. It really is illustrative. So much of the right wing, pseudo populist narrative is directly contradicted by the people who say it, their background and their experience.

I mean, you look at Josh Hawley, he’s a multiple Ivy League degree person. You look at Ron DeSantis–

LEHMANN: JD Vance.

SHEFFIELD: Yeah. JD Vance. And Peter Thiehl himself. He wants to pay people money not to go to college, but he himself has a graduate degree from Stanford. And you just go down the line.

But it’s interesting also further that, one of the other things that they kind of have in common, that this sort of non-theist libertarian right has in common with the Christian right, is that they have two things I would say. One is kind of a hatred for acquiring knowledge through experimentation, through empiricism.

To them everything is about first principles. Now, they might differ on what the first principles are, but they’re really not that different. So in other words, if you think that we should only have these, “life, liberty, property rights,” it doesn’t matter if you believe they came from God or if they just are inherent in the social contract.

If that’s your viewpoint, and your epistemology is based on everything is about proving these things are true, not about modifying my viewpoints. And, and so there’s, there’s a lot of overlap there, I would say.

SILVERMAN: And if you don’t mind, I think the way you see that in practice in tech is that, I’ve experienced this in conversations with, with tech executives and you see it all the time, is just that there’s this notion, well, one, they don’t read very much to be honest, or, or are not very historically informed.

So there’s this notion that (when) they come up with an idea, they are the first ones to ever think of that. And there’s not, say, scholarly literature or some history or genealogy of ideas or anything like that. This plays out in a couple ways that I’ll present pretty quickly, but say in crypto there, there’s a joke– Nicholas Weaver, computer scientist, who’s very vocally anti [00:28:00] crypto jokes– that crypto is speed running 500 years of financial history and making all the same mistakes.

And you see it now they’re talking about needing sort of almost central banks for crypto. Before Sam Bankman-Fried went down, he was providing kind of the JP Morgan life support role for crypto. Now it’s CZ (Changpeng Zhao) who’s the head of Binance, who’s another pretty shadowy figure, I would argue.

And they’re just, they’re figuring out that you need to, they actually might need institutions, and to replicate what we’ve spent hundreds of years through a lot of boom and bust cycles kind of figuring out.

And another example is just take a look at Elon Musk with Twitter. He took over this company, which was deeply flawed before he even took it over. But you know, he then sheds all these, all the staff, basically forces out 70 to 80% of the company and claims he’s a supposed free speech maximalist, and we’re going to get rid of content moderation, anyone can say what they want.

But what you realize pretty quickly is actually like some of those systems are in place for a reason. And that they serve certain purposes, even commercially important purposes. I think Jack Dorsey is basically an anarcho-capitalist billionaire or, or a libertarian type billionaire. But, and he had a lot of problems with how he managed Twitter, but he at least knew that you need to have a somewhat safe space for people and somewhat safe space for advertisers.

So suddenly you kind of see Elon Musk rebuilding these systems or learning on the fly, maybe not willing to admit any of his mistakes. And I think this goes back to the idea that they just think that all these ideas originate from their head, and that there’s no precedent for them, or no need to sort of question or investigate.

LEHMANN: Yeah, Sam Bankman-Fried had famously said in an interview that he doesn’t read books that if, if you’ve written a book as he put it, you’ve fucked up. Which anyone like me or Jason, who have tried to sell books, might have to conceive that he is not wrong in that.

SILVERMAN: We interviewed him for our forthcoming book, so, we’ll, we’ll see. It was in July, so before all this went down.

LEHMANN: Right, right.

SHEFFIELD: Yeah.

SILVERMAN: But there’s this definite sort of contempt there. There’s both the fake populism [00:30:00] that they all express, even though they’re millionaires and billionaires. And you’re seeing this a lot right now with Musk and the people surrounding him. I wrote an article recently for the New Republic about Davids Sachs, who’s a venture capitalist and kind of key Musk consigliere.

Every day on Twitter, Sachs is sort of denouncing elites and “blue checks” and, and these kinds of folks, and it’s like, dude, you are worth hundreds of millions of dollars and are helping re-form Twitter in your best friend’s image. You are the elite of course, but this is the kind of the kind of false populism we’ve especially seen since the Trump era.

But it works to some extent. I mean, obviously Musk has a huge fan base, but there’s a glaring hypocrisy there in how these people speak and then, and how they act in their day to day lives and in their business lives too.

LEHMANN: Right.

SHEFFIELD: Well, and it’s also they don’t understand that their market is actually small.

Elon Musk with all the changes and accounts that he’s brought back, as far as I can tell, the only left leaning account that he brought back was Kathy Griffin, who had impersonated him, the comedian. But other than that, he just is bringing back these tranches of right wing trolls.

And the thing about it though is that, he, he seems to think that there is this large body of people who would want to use Twitter, but they feel oppressed by liberals on Twitter and by what he views as a leftist censorship mob on Twitter as the former executives and employees. But the reality is there are all already multiple sites out there trying to cater to this imaginary audience.

So you’ve got–

LEHMANN: And they’re not doing well themselves either, which is

SHEFFIELD: They’re not. Yeah. Donald Trump’s Truth Social–

LEHMANN: Why, yeah, why would you want to create another app from a market perspective? It just makes no sense.

SILVERMAN: I think you’re totally right also about that overestimating their audience. I mean, and I think that comes from a couple things, but basically they’re filter bubbles that these guys live in, which is both in real life, they’re surrounded by just some close [00:32:00] hangers-on and sycophants.

And, Musk has this war room at Twitter where it’s just people he’s worked with for years or known for years, and they’re all telling him, great job, buddy. And then online, some of these people are just way too online. They spend too much time on Twitter and they think their little world on Twitter is representative of the larger culture and of real life.

It doesn’t mean Twitter’s not real, but it means that this sort of ‘war against wokeness’ and on behalf of this certain vision of free speech is not something that necessarily, to use a tech term, scales. It’s going on on Twitter among these certain circles, but it doesn’t mean that this is something that a hundred million Americans are really concerned about.

SHEFFIELD: I mean this whole idea of “blue checks.” For most people, again, the market share of Twitter is minimal a s a social media platform. Because most people don’t like it. They think it’s confusing or, whatever it is, they don’t like it and they don’t use it.

So automatically that limits what we’re talking about here. But Twitter in 2009, I believe it was, had to invent the idea of a verified social media account, right? Because they got sued because a guy was impersonating, I think it was a St. Louis Cardinals manager.

SILVERMAN: That’s right. I forgot about that.

SHEFFIELD: And so Twitter was like, okay, fine. Look, we’re going to create a system here where people can know if there’s a blue check next to an account, that it’s actually that person. And we verified that it’s them, right? And so for most people who either come into contact with Twitter on some other site, like embedded on a website or something like that, or they see it on the news or something for them, a blue check is actually positive, the idea that an account can be verified is real and legit.

And so having a platform on which you’ve got celebrities, you’ve got sports people, you’ve got journalists, you’ve got business people, and you know that it’s really them talking to you– this is a great thing for Twitter.

And it is the core value of Twitter for its audience because, again, you talk to any regular person who does use Twitter, they think that it’s great that they can go and find people that they [00:34:00] like or or hate– (laughter)

SILVERMAN: Definitely

SHEFFIELD: –and correspond with them, and tell them what they think. And they know that it’s really them. And so, so blue checks are, are, if anything, a positive thing for most people. Most people probably don’t even know what it is.

But in the right wing media space, “blue check” is actually a slur. If you read right wing blogs, they are obsessed with the, what the blue checks on Twitter are saying today and how they’re going to, how they’re going to own the libs on them.

And what’s so hilarious is that usually the people who are writing these articles saying, oh, these blue checks are saying these horrible things, they also are verified themselves. Right?

But nonetheless, they turned it into this obscure slur that no one has any reference to. Even the average Republican, if you went to Oklahoma and picked some person off the street and said, what do you think about the blue check, sir?

LEHMANN: Right.

SHEFFIELD: He would look at you like you were nuts. Because no one knows what they’re talking about. And, but it’s this, it’s just complete bubble.

And, and they all think it’s real and they all think people are upset about it, but they’re not.

LEHMANN: Yeah.

(cross-talk)

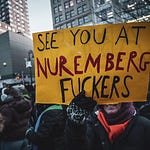

LEHMANN: And we did just run a sort of control group test of the appeal of these kind of high profile, digitally empowered culture wars in the 2022 election. We saw all these things that were supposed to cut in the Republicans’ favor, whether it be the uprising against critical race theory, the anti-woke agenda of Ron DeSantis, the don’t say gay measures in schools.

And they completely flopped. These are not things that most people with real lives understand. Students in schools are not choosing the gender identity of cat and having a litter box set up for them. It’s just crazy shit.

So, and I think you’re going to see, as the very narrow G O P House majority will embark on investigations of Hunter Biden’s laptop, and all of these intensely fetishized objects of– they’re almost talismans for this [00:36:00] belief system.

And they’re going to be dragged into the public sphere and people are going to be thinking, what the fuck? So, yeah, it is, it is a bubble.

And one of the reasons I’ve never especially liked Twitter is that it does create this kind of filtered worldview where all these culture war issues are magnified out of all recognizable proportion.

SILVERMAN: Absolutely.

LEHMANN: The whole “cancel culture” stuff. I don’t know that Thomas Chatterton Williams has a career without Twitter. I mean, I, I actually kind of liked his first memoir long ago. But yeah, there is this whole kind of –or Andrew Sullivan to take a much more egregious example. Someone who lives and breathes this stuff and has concocted the most elaborate and racist persecution complexes you can ever imagine. So there’s part of me that thinks if Elon Musk does actually destroy Twitter, I’m not going to be that sad. (laughter)

SILVERMAN: I feel similarly, even though I find it, pretty much essential for my work, unfortunately. But–

LEHMANN: Right.

SILVERMAN: I think that that filtered view and that distorted view of what matters is pretty important. Because you have, especially on the right now, they’re claiming the mantle of populism, that they’re actually in touch with everyday folks. They’re even trying to say that Democrats have failed you. You hear this sometimes: Democrats have failed their constituents on material issues. Which is actually true. But the Republicans have no plans to do the same. They’re just saying that.

But in reality, how you see this stuff play out in, in the ridiculous cultural warring that people didn’t seem to care about too much in the most recent elections, on Twitter, it does show a quite a distortion and really an inability to focus on broad issues that really matter.

I mean, one small example is, just this happens every day, but Abigail Shrier, I believe is her name. She’s wrote a book that’s broadly considered transphobic about trans youth. She’s big on the culture war, right? She posted a photo of herself at a magazine stand, I believe, at an airport, dozens of magazines on the shelf. She said, ‘How Elon Musk’s revolutionizing Twitter is the most important story going right now. None of these [00:38:00] magazines are talking about it.’

Well, a couple things. I mean, some of those magazines are like food and garden, and also magazines have long lead times, as Chris well knows.

LEHMANN: Yes.

SILVERMAN: And, but also that just shows that you think that’s the most important thing going on in America right now is what Musk is doing to Twitter, which to me is running it into the ground, to the right. He’s revolutionizing it either way. I think it’s a story that certainly matters and deserves coverage, but I would never call it the most important thing going on in tech in American society right now. It’s a little ridiculous. Certainly the fate of Twitter matters, but I think that’s the blinkered view you see a lot.

I’ve seen this also recently with the SBF [Sam Bankman-Fried] coverage because it’s become quickly politicized. SBF was a big Democratic donor. I was very glad Chris mentioned that his, one of his right hand people was a big Republican donor. They played both sides, very sadly.

But it’s being cast as the media and Democrats covered for SBF. They enabled him, they gave him power. When in reality the story is nothing like that. First of all, there are many bad actors in crypto, but it’s being put through this narrow sort of lens of that.

And then you also have a lot of people, for example, David Sachs, and I sort of called him out on this on Twitter. He was making fun of an op-ed in the Wall Street Journal that tried to sort of link SBF to MAGA or something like that. It didn’t really matter, because, as I said, The Wall Street Journal has actually done a lot of great news reporting investigations into FTX in the last couple weeks.

I’ve been reading it every day. That they might have a few op-eds that are kind of ridiculous doesn’t really matter to me or concern me. And you see this also with the New York Times. There’s this notion that people, maybe it’s a lack of media literacy. Maybe it’s just deliberate bad faith. Maybe it’s also these filter bubbles.

People think, why is the New York Times reporting on David Portnoy, this sort of boorish gambling booster as a problem and not SBF as the same type of person? Well, these publications cover many issues and publish hundreds or thousands of articles per week.

So I actually think in a lot ways, the New York Times and Wall Street Journal, for example, are doing their job on the SBF story, but anything now can be just sort of distorted and twisted through this [00:40:00] lens on Twitter where you can make this claim or stake out this claim, SBF is just a Democratic op basically, and you’ll have powerful people or people with large followings who are really ready to take that up and re-broadcast it to their own filter bubble of an audience. And then, that’s how kind of misinformation spreads.

LEHMANN: Mm-hmm. , it’s ideological whataboutism.

SILVERMAN: Exactly, yeah, that’s a more concise way of putting it. Thank you.

LEHMANN: Yeah, that why isn’t everyone as unhealthily obsessed with this subject as I am?

SILVERMAN: Exactly. And I get that all the time. Why aren’t you writing about traditional finance? I’m like, well, there are a lot of great people writing about “tradfies” I call it, which is much bigger, of course, than crypto.

But you know, right now crypto’s my beat. And there’s a lot of messy stuff to write about there. And this extends to how people treat media. I don’t think they always necessarily see the political economy of media and that people work for corporations. Sometimes you don’t always have control over what you cover or when, but also, there are competing influences and priorities and this is how it works.

SHEFFIELD: Yeah. So we’ve mentioned Sam Bankman-Fried a number of times, but for people who don’t know, what was it that FTX was doing? Just clarify for people who don’t know.

SILVERMAN: Sure.

LEHMANN: This will be quick .

SILVERMAN: I mean, basically it was a fraud. But Sam, Sam was deeply involved in the “effective altruism” movement.

He was sort of converted in college at MIT, which basically says, make as much money as you can, so you can give it all away. And you how to be the best philanthropist, not necessarily existing NGOs or the government. So Sam fell under the spell of effective altruism– or at least he sort of forsaken it recently, it’s really hard to know what’s clear.

I prefer not to psychologist him. I think what’s clear is just what he’s done, which is misappropriate vast amount of funds. But he started, just a quick capsule, he started at trading, he started at Jane Street. He was a quant trading traditional equities and securities.

And then he discovered sort of an arbitrage opportunity in the crypto markets where he was buying Bitcoin [00:42:00] on some western exchanges and then selling it at higher, slightly higher prices in Japan and some Asian exchanges. And supposedly he made millions of dollars that way. He started a research or a trading firm called Alameda, which basically evolved into a hedge fund.

And then later he started FTX, which was an exchange where everyday people were supposed to be able to trade. But it was mostly based overseas, where they could offer much more risky products, a lot of leverage. Basically, you could borrow money to make, to risk more, and it was mostly about futures and derivatives, products where you were betting on the direction that crypto would go.

You weren’t just buying Bitcoin, you were actually betting on the movements of crypto, which are super volatile. So the simple explanation of all this really is that he had these two companies both very big in their respective fields, trading on the sort of hedge fund crypto side, and then trading for regular customers.

And there was supposed to be this firewall between them. It did not exist. Money was passing back and forth freely. They basically looted their depositors,’ their main FTX customers’ money to go gamble with at Alameda and cover some holes when Alameda made a lot of bad decisions. And we can talk about how it all kind of came apart and came into view recently, but that, that’s the basic thing. He was robbing one end of his company, which he shouldn’t even have been touching that money, to make really reckless bets through Alameda.

SHEFFIELD: Mm-hmm. Okay. Yeah. And, and trying to basically buy his way into both political parties.

SILVERMAN: Oh, yeah. That’s one thing we need to make clear, which is that perhaps in an unprecedented way, actually, Sam was really openly manipulating the political system. I mean, or just call it lobbying. I mean, it’s not necessarily illegal, but he was, he was everywhere.

I mean, he, obviously, he was the second biggest donor, as Chris said, to the Democrats in the 2020 cycle, he sort of, fancifully started talking about donating a billion dollars, up to a billion in the 2024. Not coincidentally though, he, he, he backed off from that a couple months ago.

And over the summer he wound down one of his PACs, but he and his executives were [00:44:00] donating to both sides. They’re meeting with everyone. They’re quite open about the fact that they wanted the CFTC to regulate crypto and not the SEC. The CFTC is a much smaller budget, it’s much more crypto friendly, and it’s commissioners were posting selfies with Sam.

So he was quite openly pursuing a kind of regulatory capture. There’s a very quickly revolving door between government and crypto. There have been many people from Democrat and Republican administrations who have gone to work in crypto because you can get 10x the salary off the bat, if not much more.

And so, and also there’s just no, no appealing to sort of consumer interest or consumer protection. What you would have CFTC commissioners go on these listening tours as they called them, but they’re really just meeting with crypto companies. They weren’t meeting with consumer protection groups or Americans for Financial Reform, which is a group that I’ve talked to that’s very critical of crypto.

It was very one sided. So Sam could get away with this as long as crypto was seen as part of the bright future of finance. Everyone kind of thought he was this awkward but charming cherubic guy. Sam really was the person who was supposed to make crypto safe for people.

He was obviously trying to manipulate the rules and the regulations so that he could bring his company more on shore. There was a, there’s an FTX US, but it was much smaller than the FTX Global, so Sam was trying to game the system. It was all very open, but it was all kind of tolerated and welcomed. I mean, there are other people in the industry who quietly resented him.

But what he was doing was trying to legalize the casino and bring it on shore. And if he had held on for a few more months, especially with the new Republican Congress, albeit a very closely divided one, he might have succeeded. Because he has some Democrats on his side too, like [New York Democratic Sen.] Kirsten Gillibrand.

There’s even a bill that was being considered that some people called “Sam’s Bill.” And so I don’t know if you’ve ever, I mean, people who are more versed in political history might be able to draw other examples, but it was pretty stunning how open this was.

My co-author, Ben and I, over the summer, went to DC and had some, basically off the record background meetings, pretty much everyone had spoken to Sam or someone from his companies that we met [00:46:00] with.

These are people on Capitol Hill staffers and folks like that, or at least he had someone from his side had preceded us into those rooms. And it was pretty stunning to watch that play out. Obviously it’s all falling apart now. I am a little worried that we’ll get bad regulation now, but we’ll see what happens.

LEHMANN: Yeah. Well you mentioned recent political history, and the last bill I remember coming under that kind of designation was the Gramm-Leach-Bliley Bill, which basically repealed the Glass–Steagall regulations on derivatives training.

And that was called Sandy’s Bill because of Sandy Weill, who was a Wall Street Banker who aggressively lobbied for it and look how that turned out.

(laughter)

SILVERMAN: And I think that’s a good comparison also, because we’re almost, I mean, look, people are everyday people are really losing money. And I have one thing in my writing I try to do is I have a lot of sympathy for everyday “retail traders” as they’re called. Because lots of people bought into crypto for various reasons. They’re financially desperate. They believe the hype, whatever else, and why not?

When everyone was saying this was the right thing to do and celebrities and CNBC and everyone else were saying this can only go up, just like the subprime, before subprime and the housing crisis. But we actually kind of dodged a bullet that crypto, that FTX went down when it did.

LEHMANN: Right.

SILVERMAN: Because Sam in particular was also trying, besides just generally lobbying Congress and, and being a supporter of the Cynthia Lummis-Gillibrand Bill, he really wanted to expand his derivatives trading business into the US through the CFTC and wanted to kind of have the same sort of access to federal resources, to the Fed itself, and other resources as traditional Wall Street derivative trading.

So the great fear, I think, with a lot of crypto skeptics, and critics, and even lawmakers, is that it gets into the mainstream financial system, and a lot of people who have retirement accounts who don’t even directly invest in crypto become exposed to it. And–

LEHMANN: Yeah. The Ottawa Teachers Union.

SILVERMAN: Yeah, you already have a pension fund from Canada, which lost 200 million dollars, I believe, investing in FTX. There’s a [00:48:00] pension fund in Virginia, a public pension fund that’s investing in what’s called “yield farming,” which it’s just another risky form of crypto investment.

So you already had some of this institutional money coming in and Sam was the guy who institutional investors felt safe with, and if he got his hooks into the CFTC and was really allowed to do all this stuff, we’d be in big trouble, I think.

And another positive there is also that crypto wants what’s called an ETF, an exchange trade fund, which is basically another way of having exposure to crypto. They really want a Bitcoin ETF. And that would be another way to bring in more money into the casino without people directly buying Bitcoin.

And the SEC, I think to its credit, has repeatedly rejected the ETF. They pretty much copy and paste the rejection each time, no matter who’s filing for one. And they basically say these are manipulated markets. And the stable coins like Tether cannot be trusted. They’re right. And we’re fortunate that this kind of stopped, or at least lost its momentum where it did, because if this stuff went forward the way that the crypto industry wanted to, a year from now, some years from now, you’d have this stuff at everyone’s financial portfolios and retirement portfolios, at least indirectly.

And we’d be in big trouble when this goes down again.

SHEFFIELD: Yeah, yeah. No, that’s true. And there’s kind of a vulnerability here, and maybe we’ll wrap on this topic here, and that is that the ideology of corporate neoliberalism and institutional capture. In other words, it means that anyone with large sums of money can capture a neoliberal institution, and you’re seeing that with the Saudi government and various Ivy League schools. You’re seeing–

LEHMANN: And Twitter, they’re, they’re heavily in Twitter.

SHEFFIELD: Yeah.

SILVERMAN: Yeah. I wrote a piece for the New Republic under Chris about the Saudi relationship with Twitter, which has certainly not improved. I mean, Jack met with MBS and, but I won’t go off on that rant.

SHEFFIELD: Yeah. And various Republican donors have done this with universities such as George Mason University in Virginia most famously. But they’ve also [00:50:00] done it with media as well, not just with Elon Musk, but you know, you look at the way that hedge funds have basically completely captured and sucked up the local news industry, both in the newspapers and on the side of television stations.

And because neoliberalism is so institutionally worshipful, it has no real defense against this. So maybe if we can, Chris, if you can talk about neoliberalism from that aspect, and then Jacob maybe wrap it up with the idea of effective altruism. Talk about that a little bit more. So go ahead, Chris.

LEHMANN: Oh yeah. I mean, the model of neoliberalism going back to the rise of the Democratic Leadership Council in the late eighties and early nineties was first of all, Democrats weren’t winning the presidency. They needed to reset and they needed to develop a much more pro-business ideology.

And the way they did that was basically taking a host of former social goods like affordable housing, like public education and privatizing them, giving them, delivering them into models of market distribution sometimes, with some government guidance and underwriting. But very frequently not.

And so you have, this is why the charter school movement and school privatization were, signature initiatives under the Obama White House. And it is just the fallback ideology of, for neoliberalism. And it’s also why the Obama White House did such an indefensibly horrible job of cleaning up after the 2008 financial meltdown.

You got a very sort of, paper tigerish kind of body of legislation to regulate financial markets. And we’re now kind of seeing the outcome of that failure with the rise of crypto. And you had just a baseline failure to prosecute any banker for criminal activity, which I would argue, I mean, I’m not a fan of [00:52:00] carceral justice or the ideology of deterrence, but I think in Wall Street I will make an exception, because maybe, just maybe, Sam Bankman-Fried might not have happened the way it did.

So, it is important, and this goes back to the idea of the importance of government and a regulatory state serving the public interests. I mean, the other big captive agency that never gets talked about because it’s everywhere, is the Federal Reserve. It is owned and operated for all intents and purposes by the investment community.

There’s no one from labor unions who gets a seat it on the Federal Reserve Board. And you, and again, we’re seeing this play out in real time with Jerome Powell very consciously and overtly trying to tame inflation by lowering wages. Who does that benefit? It shouldn’t be hard to figure it out.

So yeah, we, we are living in an age where neoliberalism has enabled the market capture of social goods across the board. And what that means in practical terms at moments like this is that there’s no meaningful accountability.

SHEFFIELD: Well, and it also, it destroys the one thing that neoliberalism claimed it as, as its superior virtue, which was meritocracy.

But if in a system where the institutions are completely captured, there is no meritocracy because it, it is who you know. Yeah.

LEHMANN: Except it’s important. I will jump in and be pedantic here. Meritocracy was always a grift. Michael Young wrote The Rise of the Meritocracy in 1958 as a British socialist explaining the rise of civil service testing. And he just said, it is designed to siphon off the talented leadership of the working class and make them hostage.

SHEFFIELD: Uhhuh.

LEHMANN: So when we, being Americans, we just naively adopted the ideal of meritocracy as a self-evident good. It was never intended as it, as its [00:54:00] originator explained in a full length book.

It was never in meant as a social virtue. It was quite the opposite. It was a means of perpetuating the rule of capital over the interest of workers. And of course, now, Michael Young’s book, The Rise of Meritocracy, actually there’s a management imprint that has released it in the United States. That’s how badly we have misunderstood the concept.

Anyway, that’s all side rant, but I would argue that meritocracy is operating just the way it was intended to. I mean, Sam Bankman-Fried is Exhibit A of a child in the meritocracy. Both of his parents were law school professors. He was, again, history’s golden boy.

He, was on this grooved path to mogul-dom. And I will furnish now a segue out of my rant into Jacob’s portion. It is what empowers the idea of effective altruism. This new generation of 30 something tech bros are reinventing ethics because no one evidently in history has ever thought to do that.

SILVERMAN: I, I agree. And I think first of all, that that idea that there’s no accountability, whether it’s legal or even civil for both corporate malfeasance and political is certainly a defining feature of, I mean, the last 20 years, you can go back as far as you want. But it contributes to both the disenchantment with politics that a lot of people feel. And then you get people like Sam Bankman-Fried who, as Chris said, I mean a lot of people would cite his pedigree, even his parents who are law professors.

LEHMANN: Matt Yglesias did, right?

SILVERMAN: Yeah. His dad was a, is a tax scholar, which you could take a couple different ways considering his son was running an offshore grift the way he was.

And his dad, Joseph Bankman-Fried, worked for FTX. I mean I’m not saying he was up to no good. I mean like all good fraudsters, SBF kept the circle small, but just because he came from good stock or something like that, doesn’t mean he can’t be an unethical actor.

And then I think what you see then with effective altruism and the [00:56:00] “long termism” variant that SBF supposedly subscribed to, is that ‘as products of the elite, we kind of know best and, and we know how to make a lot of money and then how to distribute properly.’ In his case, he thought he was ensuring the long term survival of the human race.

I mean, he expressed some concerns about AI, but his two main issues were pandemic preparedness and crypto. And just to show how this is all kind of nonsense or a hustle, I think look at his colleague Ryan Salame, who was the Republican equivalent to SBF’s Democratic donor.

I got in a small argument with Ryan and SBF about this on Twitter a couple months ago because someone pointed out that Ryan Salame was donating money, he was also touting pandemic preparedness, essentially in line with this effective altruism idea. But he, he gave a bunch of money to Republican politicians who didn’t, who were Covid denialists basically, and didn’t believe in Covid mitigation measures.

Why don’t people like Sam Bankman-Fried promote universal healthcare, which to me counts as a very effective pandemic, mitigation measure, and certainly something that could help the public. But there’s this assumption also,

LEHMANN: Not to jump in again, but also climate change, right?

SILVERMAN: Yeah, of course.

LEHMANN: Crypto is a horrible extraction model for the carbon. It’s one of the worst carbon producing– you can can’t call it an industry cause it doesn’t make anything– but yet it does create massive amounts of carbon.

And this never figures into the effective altruism picture at all. Because effective altruism at bottom is a way to just once more give billionaires a blank check to do whatever the hell they want.

SILVERMAN: Yeah. And I, I, I think, some, some people act like, oh, well he just kind of got ahead of his skis and didn’t know what he was doing.

But it really is this, this self, this very self justifying philosophy of greed. And, there’s a pretty good article in New York Magazine by Eric Levitz in the recent FTX package about effective altruism and Will MacAskill, who was the guy who sort of the guy, and got SBF into all this.

And they [00:58:00] even talk about whether, it’s okay to be a banker or something, and things like that. At bottom, I think effective altruism can justify anything, or at least sort of deputize its adherents to justify anything.

Will MacAskill claims he’s horrified by what SBF did, but you know, he was the one who supposedly told SBF at over lunch when he was an undergrad at MIT, hey, you love animals and care about animal welfare. You should actually make a lot of money in finance and then you can contribute to animal welfare and other causes.

And so, I mean, it’s a short line from there to predatory types of finance or crypto, which is less than a negative sum game, not even a zero sum game.

So, there’s certainly aspects of effective altruism you can go into if you want to take it seriously as a philosophy. But again, it’s sort of a libertarian style abandonment of politics and arrogation of power to people with money or who already have power, who are presumed to be able to be the best kind of stewards of society if they even claim to care about society.

LEHMANN: You remind me I have the misfortune of living in Washington, which has the most artificial constituency for libertarianism on the planet. Again, talk about filters. In reality, libertarians would be lucky to claim 1% support in the general population, but because of the Koch brothers, because of Cato Institute, because of Reason Magazine, all of these things that are based in Washington, you run into libertarians all the time here.

And one of them, in his cups, once said to me well, libertarian is just an anarchist who got rich. (laughter) And that is, I think, one way to explain effective altruism.

SILVERMAN: Yeah, I think you’re right.

SHEFFIELD: Yeah. I think of it as basically Ayn Rand, run through a John Rawls filter.

LEHMANN: And nothing good can come from that. (laughter)

SHEFFIELD: Right. Well, appreciate you guys being here today. We could probably do this all day. So Jacob he’s on Twitter [01:00:00] at silvermanjacob, and then his book Easy Money‘s going to be coming out next summer, right? Is that right?

That’s right.

Okay. And you can preorder it now. And then Chris Lehman, who is the Washington Bureau chief at The Nation, he’s also on Twitter, although against his will apparently.

LEHMANN: I did launch a Mastodon account last week, so we’ll see. (laughter)

SHEFFIELD: Yeah. Right. So that’s, and for those listening, that’s L-E-H-M-A-N-N-C-H-R-I-S.

All right. Well, thank you gentlemen, and look forward to seeing all the stuff you’re coming out with in the future.

SILVERMAN: Thank you.

LEHMANN: Thanks for having us.

SHEFFIELD: And that’s our show today. And so if you want to get a transcript and video and audio of this, please go to theoryofchange.show and that’ll take you to the section on flux.community for the podcast.

And if you like what we’re doing here, you want to keep more of it, please go to patreon.com/discoverflux. I’m Matthew Sheffield, thanks for being here, and we’ll see you next time.